Small Business Technology and Skills Boost –

A Deeper Dive for SMEs

Navigating the business landscape requires agility, especially when it comes to capitalising on financial opportunities. The recent 120% deduction on skills training and technology costs is one such opportunity for SMEs. To maximise its benefits, businesses must understand and act upon its nuances.

Understanding the Significance

This legislation isn’t just about tax reductions. It reflects a broader push for businesses to embrace digital transformation and invest in workforce development, aligning with global trends towards digitalisation and continuous learning.

Eligibility Insights

- Business Turnover: The focus on SMEs with aggregate annual turnovers of less than $50 million ensures that budding enterprises, often with limited resources, can leverage technology and training to compete effectively in the market.

- Navigating the Technology Investment Boost

- Strategic Investment: Rather than investing impulsively, SMEs should conduct a thorough needs assessment. Identifying which technologies will provide the most value can make the difference between a wise investment and a missed opportunity.

- Integration: Simply purchasing technology isn’t enough. Effective integration into existing systems and training staff on its usage is crucial.

- Stay Updated: With the rapid evolution of technology, businesses should keep an eye on industry trends. Regularly attending tech expos, webinars, or seminars can provide insights into emerging tech tools.

Making the Most of the Skills and Training Boost

- Customised Training: Generic training modules might not cater to specific business needs. Collaborate with training providers to customise courses, ensuring relevance and applicability.

- Feedback Loop: Post-training, gather feedback from employees. This not only gauges the training’s effectiveness but also identifies areas for improvement.

Strategies for Effective Implementation

While understanding the nuances of this legislation is imperative, it’s equally important to focus on implementing it strategically to ensure the maximum return on investment.

- Building a Digital Culture

- Lead from the Front: Leadership teams must embrace digital tools, encouraging their teams to do the same. Active participation and championing of new technologies can create an atmosphere conducive to digital acceptance.

- Continuous Learning: Foster a culture where learning and upskilling become a regular aspect of the job. It not only benefits the business but also helps employees see a clear career progression.

Collaboration is Key

- Internal Collaboration: Involve various departments when deciding on new technologies or training programs. Collective decision-making often leads to better buy-in and more successful implementation.

- External Partnerships: Engage with tech vendors, industry experts, and training providers. Their insights can guide more informed decisions.

Monitoring and Feedback

- Key Performance Indicators (KPIs): Set clear KPIs to monitor the impact of new technologies and training programs. Regular reviews will highlight areas of success and those needing improvement.

- Employee Feedback: Actively seek feedback from employees on newly implemented technologies and training programs. Their insights can be invaluable in fine-tuning your approach.

Risk Management

Stay Informed: Be aware of the limitations and challenges associated with the technology boost. For instance, avoid hurried investments near the deadline, as they may not yield the desired return.

Diversify Investments: Instead of putting all resources into one technology or training, consider spreading the investment. It can help mitigate risks associated with any single avenue.

Future-proofing Your Business

Scalability: When investing in technology, ensure that the chosen solutions can grow with your choices: Beyond this incentive, always be on the lookout for ways to innovate. Encourage a mindset where employees continuously seek improvements, be it through technology, processes, or training.

Closing Thoughts

While the 120% tax deduction offers immediate fiscal benefits, the real value lies in its potential to transform businesses. By proactively understanding, planning, and implementing strategies around this legislation, SMEs can build a solid foundation for growth, competitiveness, and long-term success.

Future-forward Approach: Don’t just think about the present. Consider future business directions and invest in training that prepares employees for upcoming industry shifts.

Choosing the Right Training Provider

Beyond checking for registered training providers, consider:

- Reputation: Look for providers with a strong track record in delivering quality training.

- Flexibility: As SMEs often operate in dynamic environments, training providers who offer flexible schedules or modular courses can be beneficial.

- Post-training Support: Some providers offer post-training support, ensuring that employees can apply what they’ve learned effectively.

Beyond Deductions: A Long-term Perspective

While the immediate financial benefit is evident, the long-term gains are invaluable. Investing in technology boosts operational efficiency, enhances customer experience, and opens new revenue streams. Similarly, training enhances employee satisfaction, reduces turnover, and drives productivity.

Financial incentives, like the 120% deduction, are more than just short-term gains. They’re catalysts for long-term growth and competitiveness. By making informed decisions and leveraging these boosts strategically, SMEs can ensure sustained success in an ever-evolving business landscape.

Maximising the 120% Technology and Skills Training Deduction for SMEs

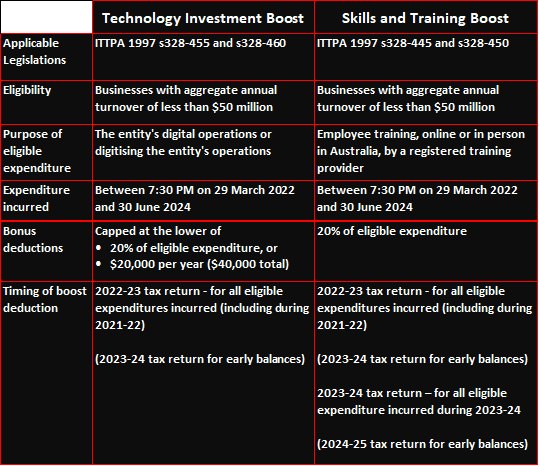

The recent legislation passed by the Parliament offers a generous 120% deduction on skills training and technology costs for small and medium-sized enterprises (SMEs). As this change comes almost a year post the 2022-23 Federal Budget announcement, understanding its intricacies is essential for effective utilisation.

Eligibility Criteria

Business Turnover: The incentive targets small business entities, which include individual sole traders, partnerships, companies, or trading trusts, with an aggregated annual turnover of less than $50 million. Aggregated turnover considers the combined turnover of your business, affiliates, and connected entities.

Key Dates

Technology Investment Deadline: Technology must be purchased and ready for use by 30 June 2023. Note that this is merely a week post the legislation’s enactment.

Technology Investment Boost Details

This boost provides a bonus deduction for expenses and depreciating assets related to digitising operations:

- Effective Period: From 7:30 pm (AEST) on 29 March 2022 to 30 June 2023.

- Examples of Qualifying Expenditures:

- Digital Infrastructure: Computer hardware, software, internet costs, systems enabling computer networks.

- Digital Marketing: Content creation, web page design.

- E-commerce: Support for online transactions, cloud-based services, digital tools for business continuity.

- Cybersecurity: Security systems, backup services.

- Restrictions: Expenses should align with the business’s digital operations. For instance, a drone purchase would be deductible only if it directly benefits the business, such as aerial photography for a real estate firm.

- Exclusions:

- Capital works costs.

- Financing costs.

- Salary/wage costs.

- Certain training or education costs.

- Trading stock expenses.

- Examples of Qualifying Expenditures:

Real-life Example

A Co Pty Ltd purchased laptops worth $100,000 on 15 July 2022 for remote working. They received and distributed these laptops by 19 July 2022. A company can now claim this amount as a deduction under the temporary full expensing in its 2022-23 tax return. Moreover, a bonus deduction of $20,000 is also applicable. However, this isn’t a direct cash return but an offset against A Co’s assessable income.

Skills and Training Boost Overview

The Skills and Training Boost promotes workforce growth by providing a 120% tax deduction for external training courses provided to employees. The primary focus is to help SMEs upskill their workforce.

- Eligibility: Only employees can benefit from this boost. Sole traders, partners, and other non-employees are excluded.

- Duration: Course registration should be between 7:30 pm (AEST) on 29 March 2022 and 30 June 2024.

- Conditions: Training should be relevant to the business’s operations, charged by a registered training provider, and delivered within Australia or online.

Which Organisations Can Offer Training?

Only courses by registered training providers qualify. Typically, vocational courses or those leading to a qualification are prioritised over professional development. Some of the registered agencies include:

• Tertiary Education Quality and Standards Agency.

• Australian Skills Quality Authority (ASQA).

• Victorian Registration and Qualifications Authority.

• Training Accreditation Council of Western Australia.

The 120% tax deduction is more than just a fiscal benefit—it’s a clarion call for SMEs to embrace the digital age and invest in their most valuable asset: their workforce. As the landscape becomes increasingly digital, SMEs should strategise, evaluate their needs, and make informed decisions to make the most of these boosts.

By Gregory Atamian JJN Associates – Accountants Tax Advisor

The content and the references made in this article are correct as at the publication date and are for general information and should not be relied upon as advice. If you wish to seek particular advice, call us on 02 9997 4000.

LEGISLATIVE REFERENCES:

The Treasury Laws Amendment (2022 Measures No. 4) Bill 2022 passed both Houses of Parliament on Thursday 22 June 2023 and received Royal Assent on Friday 23 June 2023.

The Act amends the Income Tax (Transitional Provisions) Act 1997 (ITTPA 1997) – s328-445, s328-450, s328-455, and s328-460.

Budget Measures Budget Paper No. 2 2022–23