What is a Testamentary Trust?

A testamentary trust is a form of trust that is created under the terms of a will or a codicil of a will. It comes into effect only after the death of the testator/testatrix, the person who made the Will.

The trustee of a Testamentary Trust may be the executor of the deceased estate or some other person, who will be appointed by the Will. As the trustee has full control in managing the assets, careful consideration must be given to protecting the beneficiaries from dishonesty or even incompetence.

However, trustees (and executors) have the duty to act with due diligence, impartially, perform the trusts honestly, in good faith, and for the benefit of the beneficiaries.

“The duty of a trustee to perform the trusts honestly and in good faith for the benefit of the beneficiaries, and the same applies to executors, is the minimum necessary to give substance to the trusts…”

Nettle J – Reid v Hubbard [2003] VSC 387 at 24

The principal objective of a Testamentary Trust derives from the need to hold and manage the testator’s wealth and assets in a trust for distribution to the beneficiaries as outlined in the terms of the Will. This helps alleviate any concerns regarding the protection of the assets, successful generational transmission, and of course, as a means of better tax planning.

What types of assets can be held in a Testamentary Trust?

- Properties, including land

- Shares and other Investments

- Cash

- Valuable assets, such as antiques, artworks, jewellery, coins or medallions, and other collectable items

Why establish a Testemantery Tust

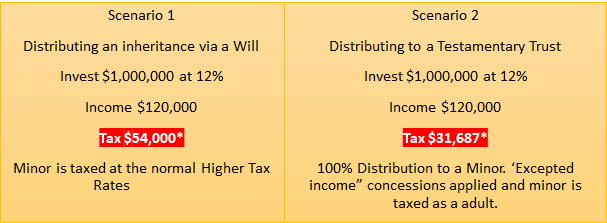

The main taxation benefit of using a testamentary trust is the income tax concessions it can provide for minors. Under Div 6AA of the Income Tax Assessment Act 1936 (Cth) (ITAA36), children are taxed as adults, i.e. obtain the benefit of the tax-free threshold. S102AG of the ITAA36 provides for ‘excepted trust income’, being a category of income derived by minors. This includes income that is derived by a minor from the property of a deceased estate, or which is transferred to a minor from a deceased estate (see s102AE(2)(c)). Otherwise, income derived by a minor will not be deemed ‘excepted income’ and will be taxed at the highest marginal tax rate of 45% higher tax rates.

*Tax calculations are based on 2022 rates.

It should be noted that in June 2020, s102AG of the ITAA36 was amended to exclude income derived from property that is unrelated to the deceased estate, that is transferred into the Testamentary Trust by another person after the death of the testator, as an ‘exempted income’. Furthermore, classes of beneficiaries not included by the deceased in their Will can no longer be added later to receive exempt income.

Other advantages of a Testamentary Trust

- Flexibility for the beneficiaries – can be setup to suit specific requirements

- Asset protection – Assets held in a Testamentary Trust are protected, up to a certain level, and therefore the assets are not available to the creditors or spouse of the beneficiaries after the breakdown of a marriage or in case of a bankruptcy

- Protection from irresponsible beneficiaries- it is up to the testator whether they vest control in the beneficiaries or in the hands of an independent trustee.

- Certain stamp duty and capital gain tax exemptions on transferring assets to the Trust

- Incapacity – In case a beneficiary is temporarily incapacitated, the family of the beneficiary, rather than an external agency, can manage the assets for the betterment of the beneficiary

Testamentary Trusts can only be established with estate assets and therefore it is important to understand which of your family assets will form part of your estate. It is vital to seek expert estate planning and tax advice to ascertain whether it is suitable for you.

By Gregory Atamian JJN Associates – Accountants Tax Advisors

The content and the references made in this article are correct as at the publication date and are for general information and should not be relied upon as advice. If you wish to seek particular advice, call us on 02 9997 4000.

LEGISLATIVE REFERENCES:

Treasury Laws Amendment (2019 Measures No. 3) Bill 2019

NSW Legislation – Trustee Act 1925 No 14

Queensland Legislation – Trust Act 1973

Victorian Legislation – Trustee Act 1958

Western Australian Legislation – Trustees Act 1962