Overview and Taxation of Trusts

What is a Trust

The principle of trust, or “Fideicommissum”, dates back to circa 200 BC, first mentioned by Publius Terentius Afer in the Roman comedy of Andria at 290–98 “tuae mando fide“, meaning “I commit to your faith”. The concept of Trust was used by the Romans where a testator would appoint a trustee as heir acting as a fiduciarius entrusted with passing the inheritance on to the beneficiaries, the so-called fideicommisarius.

Around the 12th century and under the jurisdiction of the King of England, the first inter vivos Trust was developed which permitted the transfer of an asset or gift made during one’s lifetime, as opposed to a testamentary transfer that takes effect on the death of the giver.

A Trust, therefore, is a fiduciary relationship in which one party, known as a Settlor, gives another party, the Trustee, the right to hold title to property or assets for the benefit of a third party – the Beneficiary. The trustee (individual or corporate) is required to look after the property of the trust for the benefit of the beneficiaries. Trusts are created under the law of equity and are set up to protect personal, family, and business assets.

In Australia, trust funds are among the most prevalent investment structures, set up to protect personal, family, and business assets.

Elements of a Trust

The trust deed is a formal legal memorandum that governs the operations, limitations, restrictions of the trust, and the powers of the trustee. A deed must be executed (signed) and stamped. The deed also states the parties to the trust:

- The Settlor: Responsible for setting up the trust, naming the beneficiaries, the trustee and, if there is one, the appointor. For tax reasons, the settlor should not be a beneficiary under the trust.

- The Trustee(s): The trustee administers the trust. The trustee owes fiduciary duty directly to the beneficiaries and must always act in their best interests.

- The Beneficiary(ies): The beneficiaries are the people or entities for whose benefit the trust is created and administered. Beneficiaries can be either primary beneficiaries (who are named in the trust deed) or general beneficiaries (such as existing or future children, grandchildren and relatives of the primary beneficiaries.

- The Appointor: Person who has the power to appoint and remove the trustee.

“Many forms of conduct permissible in a workaday world for those acting at arm’s length, are forbidden to those bound by the fiduciary ties. A trustee is held to something stricter than the morals of the market place.”

Benjamin N Cardozo J Meinhard v. Salmon, 164 N.E. 545, 546 (N.Y. 1928)

In addition to the trust deeds, all States and Territories of Australia have their own legislation, the Trusts and Trustees Acts as listed below. Note that these legislations do not apply to superannuation trusts which are covered under the Superannuation Industry (Supervision) Act 1993 (Cth).

Types of Trusts

Express Trusts

- Discretionary Trusts – The Trustee exercises discretion as to which beneficiaries receive distribution of income or capital

- Fixed Trusts: where the beneficiaries have a fixed entitlement to a share of the income or capital of the trust and these entitlements can’t be varied by the trustee in any way

- Unit Trusts: Distribution of income or capital of the trust can only be made in accordance with units held

- Hybrid Trusts: Have elements of Discretionary and Fixed trusts

- Bare Trusts: the beneficiary, if over 18 years of age, has the absolute right to the capital, assets and income of the trust. The trustee has no say in how or when the trust’s capital or income is distributed and must act according to the beneficiary’s instructions

- Testamentary Trusts: arises only upon the death of the testator as specified in the will. We covered this at leangh in our article Testamentary Trusts

- Superannuation Trusts: A specific form of trust designed to provide retirement or death benefits for its members, with those members being the beneficiaries. We covered this in our SMSF 3-part artticles.

- Charitable Trusts

Non-express Trusts – where there is an absence of an express or inferred intention to create an interest recognisable in equity. The main two types are:

- Resulting Trusts: Arises where the settlor confers the title to property to another person, but retains the beneficial ownership of the property either in whole, or in part

- Constructive Trusts: Imposed by the Court if there has been no declaration of a trust

Taxation of Trusts in Australia

Even though a Trust is not a separate legal entity, a Trust is treated as a taxpayer entity for the purpose of tax administration in Australia. A Trust, therefore, has its own tax file number and it must lodge an income tax return each year if it derives an income. Note that if the trust is a trading trust that conducts a business enterprise, it needs to register for an ABN and possibly GST.

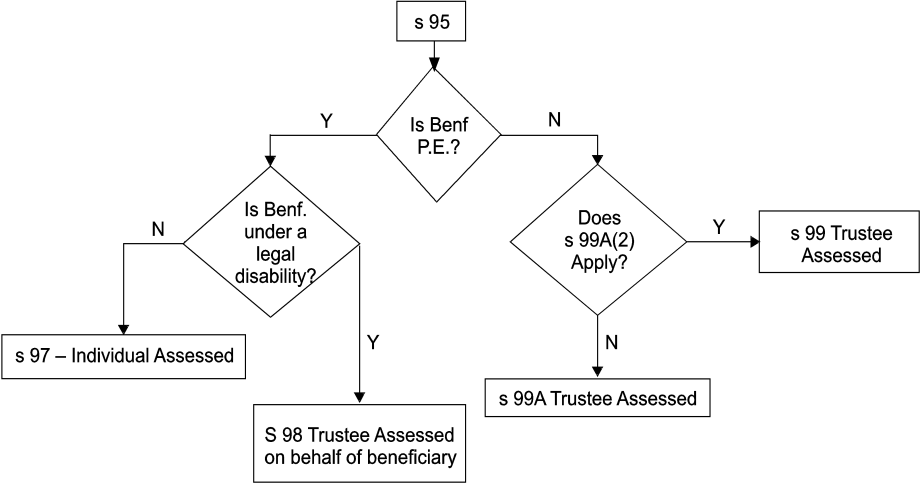

The taxation of Trust in Australia is primarily covered under the provisions of Division 6 of the Income Tax Assessment Act 1936 (ITAA36). There are several other legislative instruments as listed in the Legislative References below.

1. Tax Paid by the Beneficiaries

The trust is not subject to tax when all its annual income is distributed to the beneficiaries (on the proviso the beneficiaries are not under legal disability and are presently entitled to the Trust income). In such circumstances, the beneficiaries will pay tax on the received Trust income distribution based on their marginal rate of tax. S97 of ITAA36

2. Tax Paid by the Trustee

Under certain circumstances, the Trustee, rather than the beneficiaries, is liable to pay tax on the trust income. For example:

- Undistributed trust income: when a trust income is not fully distributed to beneficiaries, either inadvertently or by choice, the trustee would have to pay tax on the income retained in the trust at the top marginal rate of 45%

- Non-resident beneficiary: when a trust income is distributed to a beneficiary who is not an Australian resident for tax purposes, the trustee must pay tax on behalf of the non-resident beneficiary. Same applies if income is distributed to minors of non-Australian residents

- Minor beneficiary: when a trust income is distributed to a beneficiary who is under 18 years old as at 30 June of the relevant financial year, the trustee must pay tax on behalf of the beneficiary. To deter families from making trust distributions to minors, where the distribution exceeds $1,308, the top marginal tax rate of 45%. Income from a testamentary trust is an exception to this rule.

3. Trust and Personal Services Income

If you are conducting a business through a Trust structure and the income received is mostly for your personal efforts, skills or expertise, the income may be subject to the personal services income (PSI) rules. If PSI applies, the income will be treated as your individual income for tax purposes.

4. Trust distribution to children

On 23 February 2022, the Australian Taxation Office released TR 2022/D1, PCG 2022/D1, and subsequently TA 2022/1 in relation to parents benefitting from the trust entitlements of the adult children.

The rulings address schemes where income is diverted from an intended beneficiary in order to reduce tax liabilities and arrangements in relation to s100A of ITAA36 relating to present entitlements arising from the reimbursement agreement. Trustees must seek proper advice to ensure distributions comply with the taxation rulings.

Whilst trusts allow for better asset protection, tax planning, privacy, and income distribution flexibility, trusts can be very complex and costly to set up and maintain. The above is intended as a brief overview of the fundamentals.

Trust Deeds are very crucial documents to retain and should be reviewed regularly to ensure ongoing compliance with the most recent developments in the law. Family Discretionary Trusts particularly must be properly set up to avoid legal and tax complications. Proper advice must be obtained to ensure correct documentation, execution, stamping of the trust deeds are followed, necessary powers are vested in all related parties, and settled sums have been paid.

By Gregory Atamian JJN Associates – Accountants Tax Advisors

Photo: Mauna, The BS Team – Newport Beach, NSW

The content and the references made in this article are correct as at the publication date and are for general information and should not be relied upon as advice. If you wish to seek particular advice, call us on 02 9997 4000.

LEGISLATIVE REFERENCES:

NSW Legislation – Trustee Act 1925 No 14

Queensland Legislation – Trust Act 1973

Victorian Legislation – Trustee Act 1958

Western Australian Legislation – Trustees Act 1962

South Australian Legislation – Trustee Act 1936

Tasmanian Legislation – Trustee Act 1898

Northern Territory Legislation – Trustee Act 1893

Taxation of Trustees and Beneficiaries

| TRUSTEES LIABLE FOR TAX ON BEHALF OF BENEFICIARIES | |||

| Trusts generally | |||

| Beneficiary | Taxing provision (ITAA 1936) | Applicable rate | |

| Corporate beneficiary | s 98(3)(b) | Applicable corporate rate | |

| Non-resident natural person — presently entitled | s 98(2A) | Non-resident individual marginal tax rates to Australian sourced income (subject to withholding tax exclusions) | |

| Non-resident trustee beneficiary — presently entitled | s 98(4) | Highest individual marginal tax rate (45%) on Australian source income (excluding interest, dividends and royalties) | |

| Resident — presently entitled or vested and indefeasible interest (deemed present entitlement) — not under a legal disability | s 98(2)/95A(2) | Resident individual marginal tax rates on income from all sources | |

| Resident — presently entitled or vested and indefeasible interest (deemed present entitlement) — under a legal disability | s 98(1)/95A(2) | Resident individual marginal tax rates to income that is not prescribed income under Div 6AA from all sources | |

| Prescribed income of resident minors | Div 6AA | Eligible taxable income up to $416 | Nil |

| Over $416 up to $1,308 | minimum of 66% of excess | ||

| From $1,308 | 45% | ||

| Prescribed income of non-resident minors | Div 6AA | Eligible taxable income up to $416 | minimum equal to 32.5% |

| Over $416 up to $1,308 | minimum $135.20 + 66% of excess over $416 | ||

| From $1,308 | 45% | ||

| No beneficiary presently entitled | s 99A | Highest individual marginal tax rate | |

| No beneficiary presently entitled — Commissioner’s discretion | s 99 | Marginal tax rates | |

| No beneficiary presently entitled — income from the assets of a deceased estate | s 99 | Marginal individual tax rates for up to 3 income years from the time of death | |

| No beneficiary presently entitled — income not from the assets of the deceasedfrom 4th income year | s 99/102AG(2AA) | Marginal individual rates without benefit of tax-free threshold resulting in equivalent of a flat rate of 19% being applied when income exceeds $416 |